Reserves Evaluation

BED-1 Report Highlights

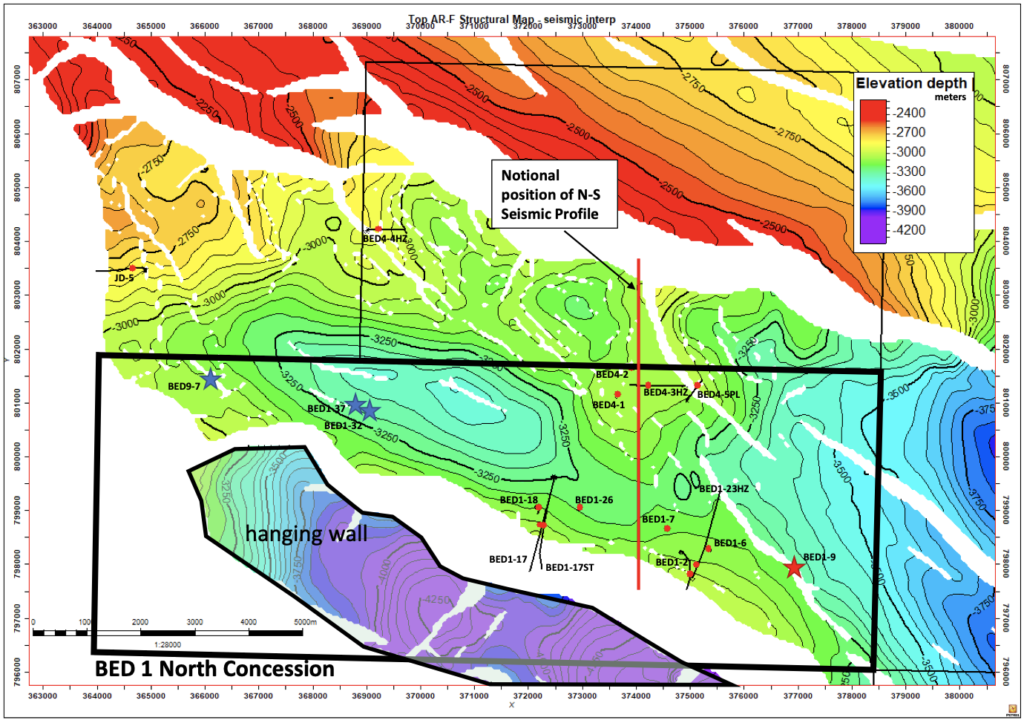

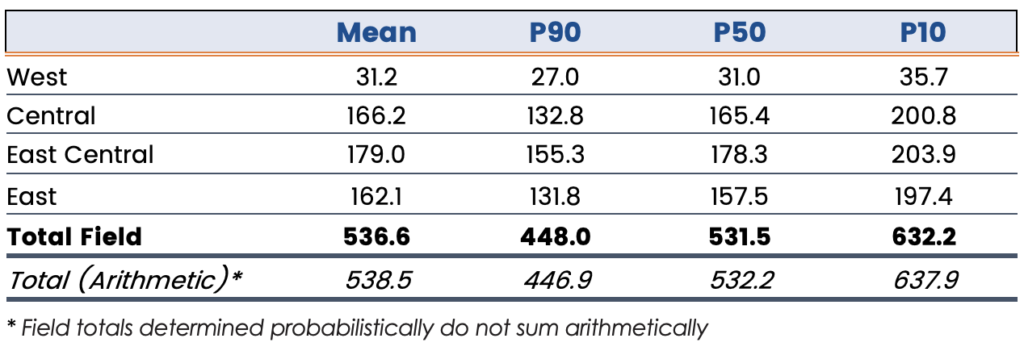

RPS Energy Canada Ltd. (“RPS”) estimates the Abu-Roash “F” formation (“ARF”) oil-initially-in-place (“OIIP”) P50 Volumes to be 531.5 million barrels over the Badr-1 (“BED-1”) concession area and Mean Volumes to be 536.6 million barrels. The discovered OIIP in the ARF is imaged by 3D seismic coverage, significant well control with over 30 penetrations, petrophysical analysis of available log and core data and production tests from the ARF.

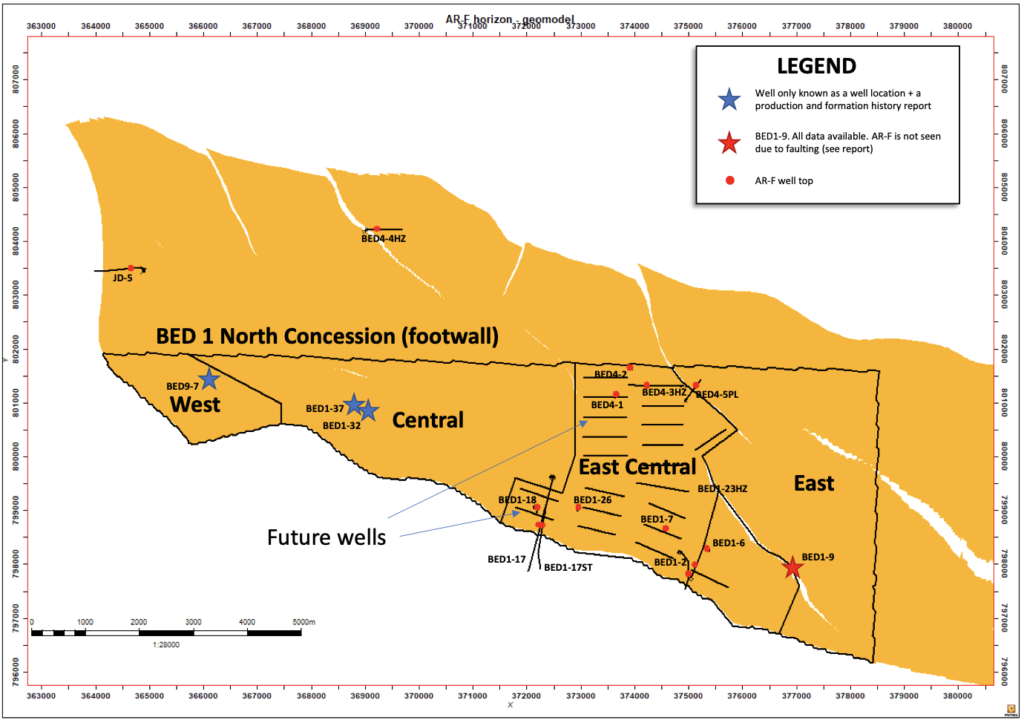

- TAG Oil’s current Field Development Plan (“FDP”), consisting of drilling 20 horizontal wells to be completed with multi-stage fracture stimulation, is focused on the east central part of the BED-1 concession area and contains OIIP P50 Volumes of 178.3 million barrels and Mean Volumes of 179.0 million barrels.

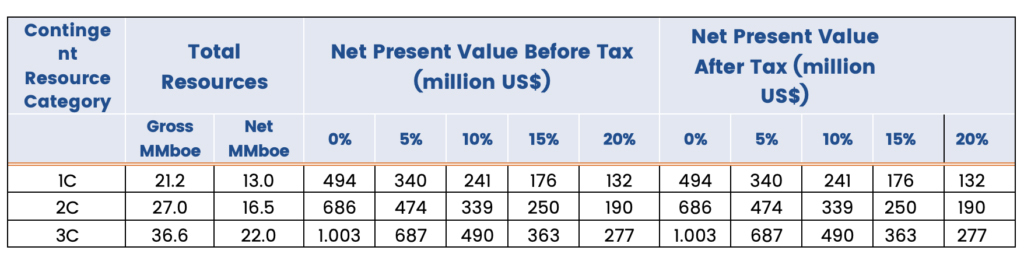

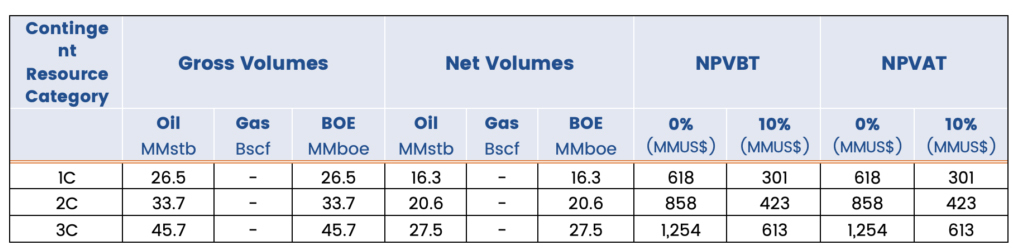

- RPS estimate for Contingent Resources (2C Development Pending) net present value discounted at 10% and assumed RPS Price Forecast of April 1, 2022, per barrel is US$339 million (risked at 80% chance of development) and US$423 million (un-risked).

- FDP Operating investment discounted at 10% is US$160 million for the 2C Development Pending Contingent Resources in the ARF.

- RPS best estimate for Contingent Resources volumes (2C Development Pending) is 27.0 million barrels gross with 16.5 million barrels net to the Company.

- FDP Capital investment discounted at 10% is US$104 million for the 2C Development Pending Contingent Resources in the ARF.

- TAG Oil’s current Field Development Plan (“FDP”), consisting of drilling 20 horizontal wells to be completed with multi-stage fracture stimulation, is focused on the east central part of the BED-1 concession area and contains OIIP P50 Volumes of 178.3 million barrels and Mean Volumes of 179.0 million barrels.

- FDP Capital investment discounted at 10% is US$104 million for the 2C Development Pending Contingent Resources in the ARF.

- FDP Operating investment discounted at 10% is US$160 million for the 2C Development Pending Contingent Resources in the ARF.

- RPS best estimate for Contingent Resources volumes (2C Development Pending) is 27.0 million barrels gross with 16.5 million barrels net to the Company.

- RPS estimate for Contingent Resources (2C Development Pending) net present value discounted at 10% and assumed RPS Price Forecast of April 1, 2022, per barrel is US$339 million (risked at 80% chance of development) and US$423 million (un-risked).

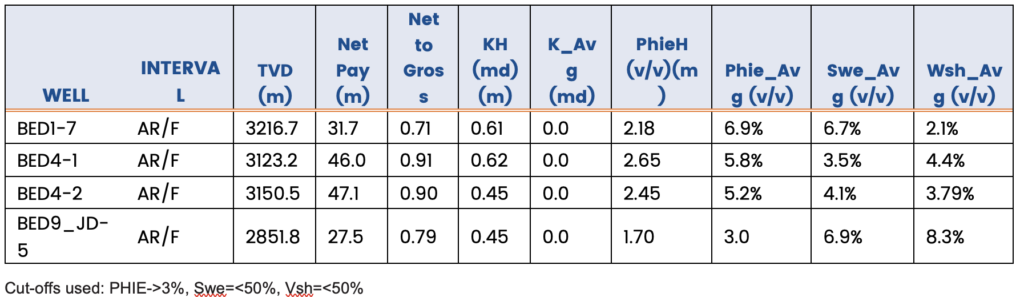

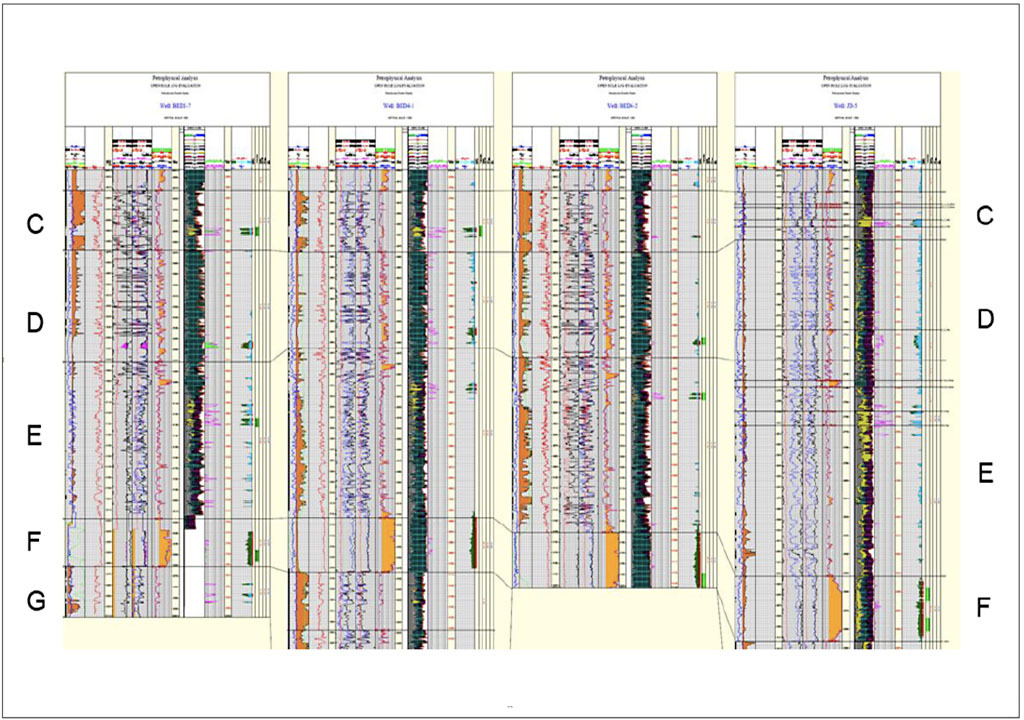

Summary of Petrophysical Results in ARF Formation

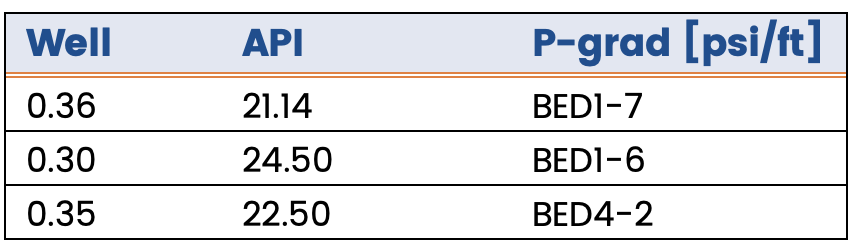

Oil Gravity and Pressure Gradients

The fiscal structure of the Petroleum Services Agreement includes TAG bearing the burden of all costs for the project, including all capital and operating costs on behalf of the parties for a share of revenues from the ARF development in BED-1, payable as a fee equal to a percentage of the total gross revenues generated from production.

Log Cross-section and Stratigraphy through Wells,

BED-1-7, BED-4-1, BED-4-2, and JD-5 in the ARF Formation

TAG Development Areas in

BED-1 North Concession

The royalties and taxes payable in the Arab Republic of Egypt (“ARE”) are assumed by EGPC on behalf of TAG and payable from their share of gross revenues and TAG shall be exempted from all taxes and duties imposed by the government of ARE or municipalities.

ARF Oil Initially In Place (“STOIIP”) Volumes (MMstb)

Summary of Contingent Resources Volumes and Net Present Values

Resources Summary - Unrisked

Badr El Din-1 License, Abu-Roash "F" Development

As of July 1, 2022

RPS Price Forecast 2022-04-01